The above table is interpreted as follows:Ĭompany PQR paid 5.794 times to its vendors in a year on average, and Company XYZ paid 6.247 times in a year. Now that we have calculated the ratio (‘in times’ and ‘in days’) annually, we will interpret the numbers to understand more about the company’s short-term debt repayment process. Let’s interpret AP Turnover Ratio for the above example. In conclusion: AP Turnover Ratio Conclusion Data to calculate the AP Turnover Ratio Sr.

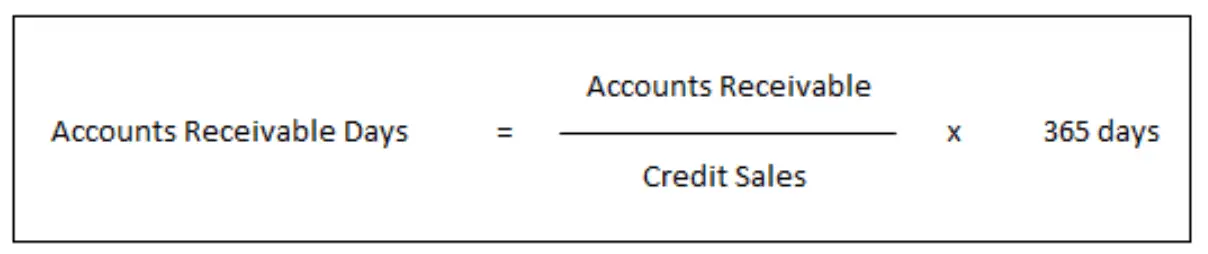

Question: Following is the data of two Companies, PQR and XYZ, for calculating the AP Turnover Ratio. Let's take a few examples for the calculation of the ratio.įor the first example, we'll take a look at the question provided below: Average Accounts Payable = (Opening Balance of AP + Closing Balance of AP)/ 2Įxample of Accounts Payable Turnover Ratio.Net Credit Purchases = Total Purchases - (Cash Purchases + Purchase Returns).The formula for APTR is as follows:Īccounts Payable Turnover Ratio (APTR) = Net Credit Purchases/ Average Accounts Payable To better understand the formula, let us look at the illustration below. The average accounts payable is the average opening and closing balances. The net credit purchases include all goods and services purchased by the company on credit minus the purchase returns. Accounts Payable Turnover Ratio FormulaĪPTR is 'net credit purchases' divided by 'average accounts payable balance.' Although streamlining the process helps significantly for the company to improve its cash flow. The volume of the transactions handled by the company determines the AP process to be followed within an organization.Ī business with low volume transactions will opt for the basic AP Process.

The balance of the AP varies throughout the year as the difference between the opening balance and the closing balance of the AP in the balance sheet gets recorded in the Cash Flow Statement under 'Cash Flow from Operating Activities.' Thus, they fall under 'Current Liabilities.' AP also refers to the Accounts Payable department set up separately to handle the payable process. These are short-term liabilities, i.e., are payable within 12 months from the date the credit is due. We have now seen "What the Accounts Payable Turnover Ratio is?" Let's understand the term 'Accounts Payable.' What are Accounts Payable (AP)?Īccounts Payable refers to those accounts against which the organization has purchased goods and services on credit.Īccounts payable also include trade payables and are sometimes used interchangeably to represent short-term debts that a company owes. It focuses on identifying strategic opportunities, giving the company a competitive edge through sourcing quality material at the lowest cost.Ī good understanding of the AP Turnover Ratio is vital for the growth of an organization. It also measures the operating efficiency in terms of placing orders, verifying invoices, checking inventory, making payments, and taking into account the working capital management of the business for meeting current and future needs.Ī good AP Turnover Ratio also takes care of vendor relationships. It, therefore, measures short-term financial liquidity. Then, it determines the frequency of payments made by the company to its creditors.ĪP Turnover Ratio falls under the category of Liquidity Ratios as cash payments to creditors affect the liquid assets of an organization. The company calculates the ratio over a period of time, which could be monthly, quarterly, or annually. It is also sometimes referred to as the Creditors Turnover Ratio or Creditors Velocity Ratio. It calculates the rate of paying off the supplier by the company.

0 kommentar(er)

0 kommentar(er)